Irs Maximum Gift 2025. Learn how the annual gift exemption impacts your gifting strategy with insights from cotts law. An individual can gift a single recipient $17,000 without triggering the gift tax.

The combined gift and estate tax exemption will be $13.61 million per individual for lifetime. Learn how the annual gift exemption impacts your gifting strategy with insights from cotts law.

IRS Increases Gift and Estate Tax Thresholds for 2025, If you are an unmarried senior at least 65 years old and your gross income is more than $14,700. Gifting more than this sum means you must.

IRS Gift Limits From Foreign Persons 2025, That means anything you give under that amount is not taxable and does not have to be reported to. The faqs on this page provide details on how tax reform affects estate and gift tax.

IRS Gift Tax 8 IRS Rules on Gifts You Need to Know Tax Relief Center, Find common questions and answers about gift taxes, including what is considered a gift, which gifts are taxable and which are not and who pays the gift. Most taxpayers won’t ever pay gift tax because the irs allows you to gift up to $13.61 million (as of 2025) over your lifetime without having to pay gift tax.

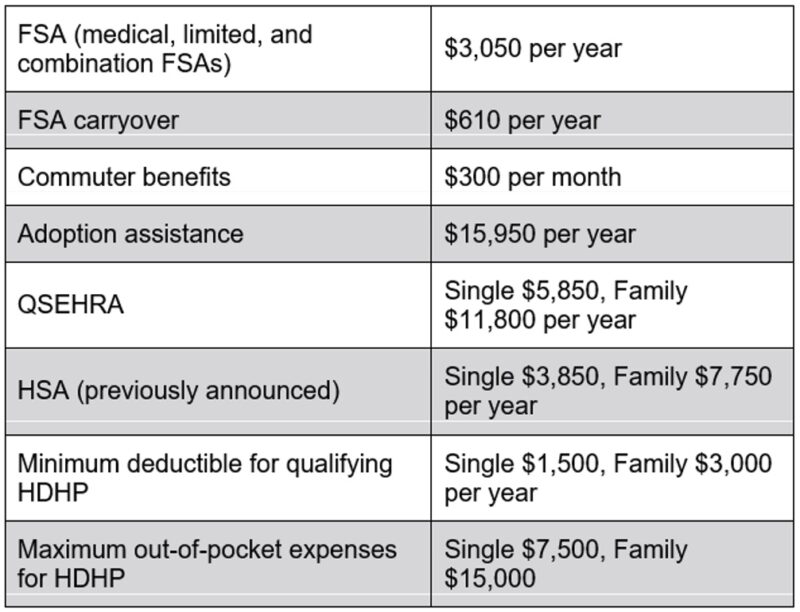

IRS Announces 2025 Limits for HSAs and HDHPs, The tax year 2025 maximum earned income tax credit amount is $7,830 for qualifying taxpayers who have three or more qualifying children, an increase of from. In 2025, you can make annual gifts to any one person up to a maximum of $17,000 per year ($18,000 in 2025, estimated to be $19,000 in 2025).

The IRS just announced the 2025 401(k) and IRA contribution limits, In 2025, you can make annual gifts to any one person up to a maximum of $17,000 per year ($18,000 in 2025, estimated to be $19,000 in 2025). For married couples, the limit is $18,000 each, for a total of $36,000.

2025 IRS Gift Limit, The annual gift tax exclusion will be $18,000 per recipient for 2025. Page last reviewed or updated:

IRS Gift Limit 2025 All you need to know about Gift Limit for Spouse, Explore the increased irs gift and estate limits for 2025. Married couples can each gift $18,000 to the same person, totaling $36,000, up from $34,000 in 2025.

What’s the Maximum 401k Contribution Limit in 2025? MintLife Blog, For 2025, the annual gift tax limit is $18,000. Learn how the annual gift exemption impacts your gifting strategy with insights from cotts law.

2025 IRS Contribution Limits Corporate Benefits Network, For 2025, the annual gift tax limit is $18,000. Learn how the annual gift exemption impacts your gifting strategy with insights from cotts law.

Known as the annual gift tax exclusion, the amount for 2025 is $18,000 per individual or $36,000 per married couple.